STOCKS VS REAL ESTATE – WHICH IS BEST?

Introduction

In the realm of wealth-building, the choice between investing in mutual funds or real estate is a decision that many consider.

This week we take a look at the complexities, advantages, and challenges associated with these two well-known avenues. Both stocks and real estate offer distinct pathways to financial independence, and our aim is to guide you through a comparative analysis, shedding light on the often-overlooked possibilities within the vast landscape of real estate.

Understanding Each Investment Avenue

Mutual funds, the common go-to for many investors, act as a basket of various stocks, providing diversification across multiple companies. Managed by professionals, they demand less individual research and are highly liquid, easily accessible, and are the primary investment available in 401(k) plans. Harland and I have individually invested a substantial portion of our early adulthood savings in mutual funds.

On the flip side, real estate is tangible, always valuable, and offers a different kind of investment. While it requires additional learning, the physical engagement with the asset adds a unique dimension of security. Landlording may be the most common way people invest in real estate. There are also many other options for investors who do not wish to actively manage rental property.

Risk and Returns

Mutual funds, with an average annual growth of 9-10 percent, present an attractive option. However, their volatile nature is underscored by historical events like Black Monday in 1987, the Dot Com bubble burst, the global financial crisis in 2008, and the recent COVID pandemic. It is not uncommon for the overall market to be up or down 30-40 percent within a given year. Sometimes the drop is over a few days and it can take years to recover.

Real estate, however, has demonstrated consistent returns in the low to mid-teens and higher, showcasing its resilience even in challenging times. Some of the risk is reduced by having direct control with the management, as opposed to management by a fund manager we don’t know.

Capital Requirements and Liquidity

Mutual funds boast a low entry barrier, allowing investors to start with minimal capital and often allow for automatic investments.

Real estate, requiring a more substantial initial investment, contrasts with mutual funds’ accessibility. While mutual funds shine in terms of liquidity, real estate demands a longer-term perspective and is less liquid.

Income Generation

Mutual funds generate income through dividends and the appreciation of underlying stocks.

Real estate provides alternative avenues – rental income and property appreciation. The positive cash flow from real estate acts as a cushion against market fluctuations.

Tax Implications

Mutual funds require annual taxes on income and capital gains, creating potential tax burdens for investors. Because the fund manager will be selling and buying shares throughout the year, a tax liability can be created even if an investor does not sell any shares of the fund.

Real estate offers several tax advantages. Some of these include depreciation benefits and deferred taxation on equity buildup until the property is sold. The depreciation benefits can help offset rental income, and sometimes other income.

Market Conditions

The unpredictability of mutual funds, susceptible to rapid market shifts triggered by global events, demands that investors stomach downturns, recessions, and bear markets. How would you react if your nest egg dropped in value 40-percent? How long can you wait for the recovery?

Real estate, with its own market changes, allows investors to ride out fluctuations, continue collecting rental income, and exercise more control over impulsive reactions. If you have positive cash flow producing income, would it be easier to ride out a downturn in the market?

Summary

Choosing between mutual funds and real estate depends on individual factors, including life stage, investment knowledge, and comfort.

Balancing both can provide significant advantages, with mutual funds serving as a stepping stone for beginners and real estate offering stability, unique income streams and growth.

Consideration of control in strategic decision-making is crucial. Investors can also use their IRAs to delve into real estate.

In our next discussion, we’ll delve into the practical aspects of using real estate as a vehicle towards financial independence. Stay tuned for insights into passive real estate investments. We appreciate your company on this insightful journey.

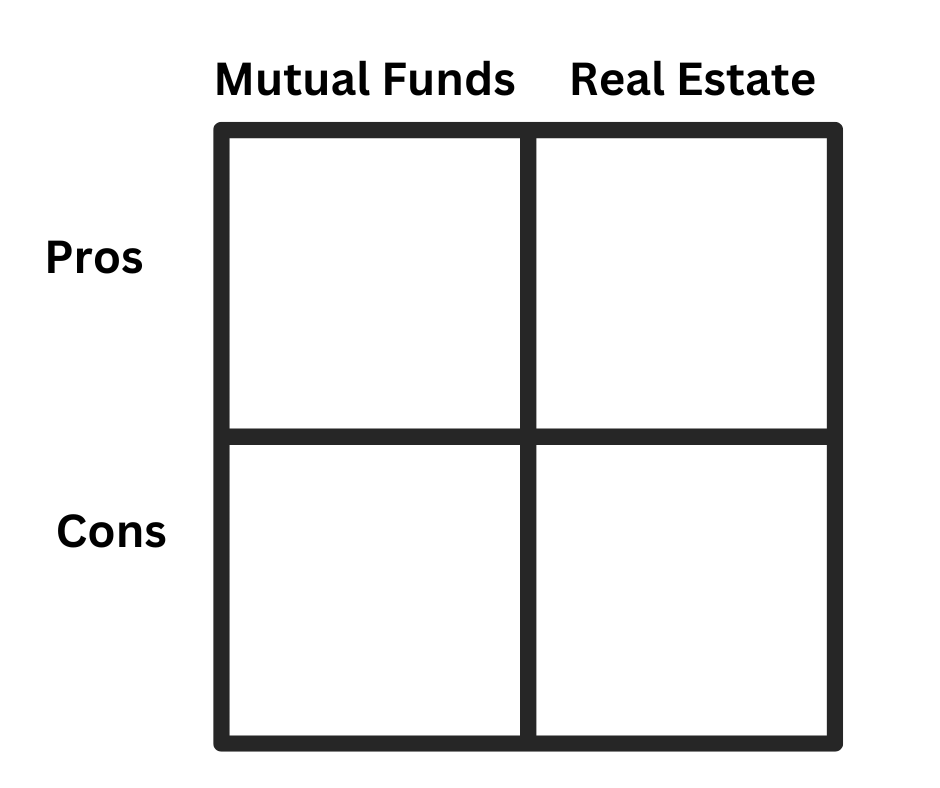

As you ponder your investment choices, grab a sheet of paper and list the pros and cons of mutual funds and real estate. What aligns with your goals and comfort level? Your decision today shapes your long-term financial independence.

HELP US GET TO KNOW YOU BETTER

Join us at noon Eastern time on the third Wednesday of each month as multi-family investors network and engage in conversations about how to be better investors. We discuss opportunities and what we are doing in the current market. Watch for the Zoom link if you have subscribed to the blog.

The next virtual meetup is Wednesday, December 20, 2023 at noon (Eastern). Look for details on a guest speaker.

Attune Investments provides a better return for our investors. And we make a positive impact in people’s lives and in our world.

If you want to learn more about how others are investing with us then we invite you to join our club and request a conversation with us. See below.

Through the power of a syndication partnership with other investors like you, working with managing partners who are experienced in managing apartment complexes, you can own multifamily assets.

Or you can choose to loan money, get in with a clear return, and get out earlier.

If you haven’t already subscribed to our BLOG, you can increase your knowledge and comfort with this asset class by subscribing now. It’s free. We publish an article every week. SUBSCRIBE HERE And take one more step. Become a member of our ATTUNE INVESTORS CLUB in which you have more personal access to us. JOIN HERE.

Mike is a retired aerospace engineer with a passion for real estate investing and teaching financial literacy. He lives with his wife in Daytona Beach, Florida.