Choosing Where To Invest In Real Estate

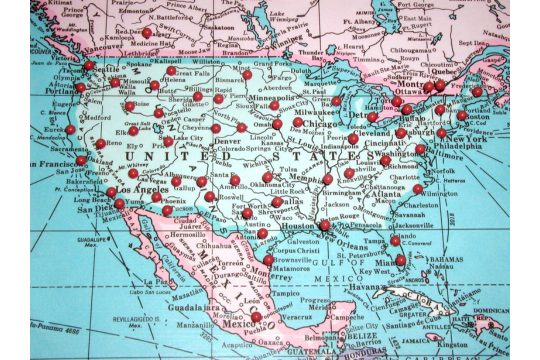

LOCATION, LOCATION, LOCATION:

Choosing Where To Invest In Real Estate

You may have seen it in the headlines or the news. A squatter moves into a house and it takes months for the rightful owner to regain possession of the property. We are not talking about tenants who had a lease and just did not pay their rent. These are people who moved in and changed the locks, preventing owners and police from returning the property to the rightful owner. Some of the homes belong to landlords, others are heirs who are trying to gain access to their inheritance.

Fortunately, some states are responding to make it clear that squatters do not have the right to live in a property that is not theirs. Florida Governor Ron Desantis recently signed a bill into law that protects property owners from squatters. He said, “If you’re the victim of squatting, you can simply fill out a form, give it to your local sheriff and the sheriff is instructed to go and remove the people who are inhabiting your dwelling illegally.”

You might wonder if this really matters to investors in multi-family properties.

The answer is that it should.

Here are three ways we look at how location matters when it comes to choosing where to invest in multi-family real estate.

Three Things We Look For

There are at least three things that we consider before we even look at a property for numbers and profitability as a potential investment. We call it initial screening. We don’t care how the numbers look if it is going to take a year to get someone out of a property who does not belong there or is not paying rent on time.

One. Location Is In A Landlord Friendly State

Is this a landlord friendly state?

The action taken by Governor Desantis is only one indication of how landlord friendly the state is. The state legislature and governor agreed that the rights of property owners should be protected.

Most states establish laws that prescribe the rights of tenants and landlords. With a little bit of searching on the internet a person can determine how much notice landlords and tenants must give to end a lease. Some states are making it harder for landlords to not renew a lease. Some states prescribe how much rent can be increased. You can also find out how long it takes to evict someone for non-payment of rent.

Two. Location Is In A Tax-Friendly State

Is this a tax-friendly state?

There are two primary types of taxes affecting real estate investments. One is a state income tax, the other is the local property tax.

Imagine being a partner in several different partnerships in different states. At the end of the year, most of them made money. Then your accountant informs you that you need to file tax returns in some of those states because that is where some of your income came from. That is an additional burden and tax upon you as an investor.

Some states withhold taxes upon the sale of real estate.

I don’t like to make investing more complicated for our investors. And I really don’t like paying additional income or capital gains taxes in another state.

So we choose to invest in states that do not impose a state income tax.

Local property taxes can also make a significant difference. It is important to estimate what property taxes will be if you purchase a property as they will usually go up as a function of the sales price.

Three. Location Is In A Growth Area

Is this a growing state or metropolitan area?

It might be more appropriate to look at growth of specific cities that pass the first two filters above. This information can also easily be found on the internet.

Where are people moving to? Are there particular cities within the state that are growing faster? What is the source of the growth? U-Haul and moving companies provide data on where people are moving from and where they are going.

Are multiple companies choosing to relocate or expand in the area? Are there military bases or government functions that are being expanded?

In years past, breaking ground for a new McDonald’s location was a good indicator of strong growth ahead. Now we like to see Chick-fil-a and Amazon.

But if the growth is based on a single company the prospects can change overnight. We like to see multiple companies moving or expanding into an area.

What are the demographic changes? Is the population change due to people moving in for jobs? Or are they coming in for retirement? The increased ability to work from home over the last few years has enabled more people to choose to live where they really want to instead of having to be close to an office.

Conclusion

Location, location, location. When it comes to real estate investing, it really does matter. It’s not just about the numbers and expected return on investment. We want to choose a location that is landlord friendly, tax friendly, and has increasing growth prospects.

Help Us Get to Know You Better

Join us at noon Eastern time on the third Wednesday of each month as multi-family investors network and engage in conversations about how to be better investors. We discuss opportunities and what we are doing in the current market.

Engage with other multifamily investors like you. See you then

Attune Investments provides a better return for our investors. And we make a positive impact in people’s lives and in our world.

If you want to learn more about how others are investing with us then we invite you to join our club and request a conversation with us. See below.

Through the power of a syndication partnership with other investors like you, working with managing partners who are experienced in managing apartment complexes, you can own multifamily assets.

Or you can choose to loan money, get in with a clear return, and get out earlier. If you haven’t already subscribed to our BLOG, you can increase your knowledge and comfort with this asset class by subscribing now. It’s free. We publish an article every week. SUBSCRIBE HERE And take one more step. Become a member of our ATTUNE INVESTORS CLUB in which you have more personal access to us. JOIN HERE.

Mike is a retired aerospace engineer with a passion for real estate investing and teaching financial literacy. He lives with his wife in Daytona Beach, Florida.