CREATING A SHARED VISION

Expanding The Foundation For Financial Success

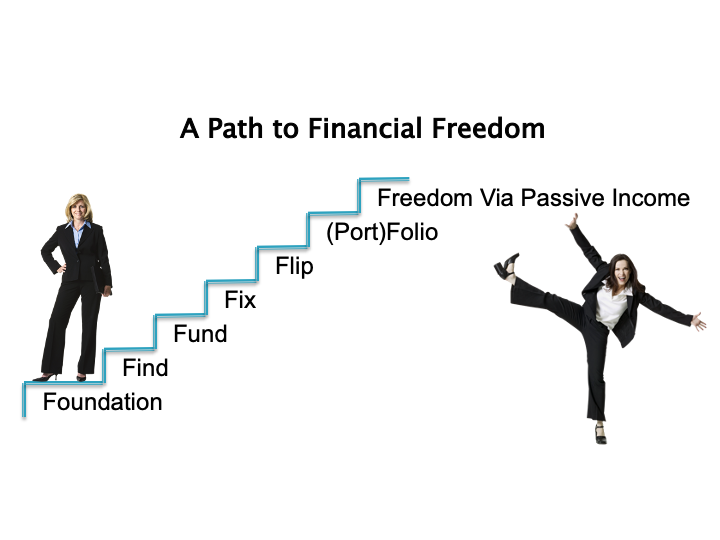

It was sometime after obtaining our first rental property that I actually had a written plan. I called it A Path To Financial Freedom. It had 7 steps to reach financial freedom with real estate.

It looked like this:

Foundation, Find, Fund, Fix, Flip, (Port)folio, Financial Freedom.

I thought that it sounded great. It is a written plan and is consistent with what is taught at many real estate investor clubs.

We did a few fix and flip houses but then decided that holding them in our portfolio would be a better way to accumulate long-term wealth and cash flow.

However, not everybody wants to flip houses. It can be a job.

Some people choose to wholesale properties without fixing them. This is another job.

Many people jump into real estate and start taking seminars. Getting an education is great and necessary. But then they get distracted and start chasing another niche every month or two. They never really get started.

Other people study the numbers but are afraid to take the plunge. We call this analysis paralysis. Some become seminar junkies and want to know everything before they actually get started investing.

There are so many options and niches.

I had a W-2 job that was sometimes great and interesting, but sometimes stressful with required overtime. And sometimes threatened with layoffs. There was a false sense of security.

The company raised the normal retirement age. Later it implemented a plan to freeze pensions effective on a set date.

It was like a carrot on a stick being put farther and farther away. Then the carrot was taken away.

I wanted to provide multiple streams of income for my family. The income streams needed to replace the income we had from working.

Some people start businesses and end up working 16 hours a day. This can lead to divorce. This happened to a friend of mine who opened a coffee shop. The business might eventually make money, but the time investment can take a heavy toll on health and relationships.

How much time are you willing to give toward a business? Or learning how to invest?

How much time do you want to spend with your family and others that you care about?

It felt like a balancing act while our kids were in school. My wife and I wanted to spend as much time with our kids as possible when they were growing up. You don’t get that time back after it is gone.

We were able to achieve financial independence. But there are always challenges with a business. Like how to grow it, how much and how fast. How much debt to take on. Or how to solve issues when they arise. And the time it takes to solve those issues. Sometimes you need to have your own boots on the ground.

ENTER THE MASTERMIND

We joined a mastermind two years ago with other experienced real estate investors. This was an opportunity to learn from other investors who are not our competitors. I had seen other investors’ success increase dramatically after joining a mastermind so we decided to try it.

People live in different parts of the country. Some are in different niches, and none are competitors to us. We have lenders, people focused on single family houses, some who buy mobile homes and mobile home parks, and some who buy apartments.

Some people will end up doing deals together.

Everyone talked about their own real estate business. What was going well. What wasn’t going well. And what is holding us back.

We shared possible solutions. What worked well for us when in a similar situation.

This particular mastermind included spouses. That brought another spectrum of insights as most spouses are not active in the real estate business but are greatly affected by it. They usually benefit financially and the time flexibility can be advantageous. But if investments bring financial strain the spouses will feel that as well. And my wife, who calls herself the Not So Silent Partner, will definitely be heard.

A mastermind can also help expand your view of what is possible.

CREATE THE VISION

For many people creating and growing the business or portfolio is only the beginning. They then try to fit their life around the business.

The problem with that approach is we run out of time to do the things we want with our friends and family.

One thing that we were asked to do was write out our vision of what we wanted our life to look like.

At one point we thought our vision was to retire to the beach and travel. This sounds great, but it is missing a few things.

Having financial independence is only one part of the solution.

We each have a need for significance. My wife was a nurse helping people for over 35 years. It is different when you don’t have people depending on you every day.

Relationships matter. We want to spend time doing things with people that we enjoy being with.

Health matters. I spent many years working hard and growing our real estate portfolio. But my physical fitness suffered because I neglected it.

We each have a need to give. This can include both time and financial support.

It is much better to design a business around the life that you want to live. This is why your vision should be part of the foundation for your financial freedom plan. And the vision can change over time.

Do you want to spend time swinging a hammer and doing the work rehabbing properties? Or do you prefer to spend it finding properties and structuring deals?

If you want to own rental properties, do you want to be a landlord? Or do you want to hire a property manager?

Life is like a roll of toilet paper. The farther along you go, the faster it seems to go. And time seems to become more valuable to us.

If I have to spend 16 hours a day running a coffee shop it would be difficult to take two weeks off for a cruise. Or take three weeks to bike in Europe like my friend Charlie does every June. Some of our friends spent over four weeks traveling the country last summer with their families. That creates memories and friendships that the kids will remember for a long time.

Do you have to collect rent checks and deposit them? We have all of our residents pay online to simplify collections. Checks don’t get “lost in the mail” and the date paid is recorded electronically.

The vision is like a rudder that can provide direction for your business. By business I am including an investment portfolio because investments are supposed to be run like a business. If an investment or business is too time consuming it can take you away from living your vision.

Part of my vision includes traveling throughout the United States, Caribbean Sea and Europe. And diving the Great Barrier Reef off the coast of Australia. To do this I need to be able to run my business remotely, from anywhere in the world.

Spouses also need to be involved in creating the vision. Each spouse needs to create a separate vision, then come together and agree on a joint plan. Don’t avoid putting something on the list just because you don’t think that your spouse is interested. You could be surprised. And there may be some items each spouse needs to do on their own.

DESIGN THE BUSINESS AND CHOOSE YOUR INVESTMENTS

Once you have created your vision it becomes much easier to decide what investments make sense and fit your vision. Do you want to be an active business owner? Do you want to wholesale properties? Do you want to fix and flip? Do you want to be an active investor or passive? Do you want to be an active landlord or let someone else have the joys of property management? Do you want to spend time now finding properties and building a portfolio? Or do you want to be passive and let someone else do the heavy lifting?

LET’S GET TO KNOW EACH OTHER BETTER.

Attune Investments provides a better return for our investors. And we make a positive impact in people’s lives and in our world.

If you want to learn more about how others are investing with us then we invite you to join our club and request a conversation with us.

Through the power of a syndication partnership with other investors like you, working with managing partners who are experienced in managing apartment complexes, you can own multifamily assets.

Or you can choose to loan money, get in with a clear return, and get out earlier. If you haven’t already subscribed to our BLOG, you can increase your knowledge and comfort with this asset class by subscribing now. It’s free. We publish an article every week. SUBSCRIBE HERE

And take one more step. Become a member of our ATTUNE INVESTORS CLUB in which you have more personal access to us. JOIN HERE

After you join, schedule a call with one of us and we can get to know each other better and answer your questions. We are required by the SEC to build a relationship with you before we can share any specific investment opportunities. So JOIN TODAY.

You can also find us on Facebook at OUR ATTUNE INVESTMENTS FACEBOOK PAGE.

If you like something you see here please share it with others.

Mike is a retired aerospace engineer with a passion for real estate investing and teaching financial literacy. He lives with his wife in Daytona Beach, Florida.